unemployment tax credit refund

1 the IRS announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020. The deadline for filing your ANCHOR benefit application is December 30 2022.

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

. The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments. Get in Touch. The unemployment tax refund is only for those filing individually.

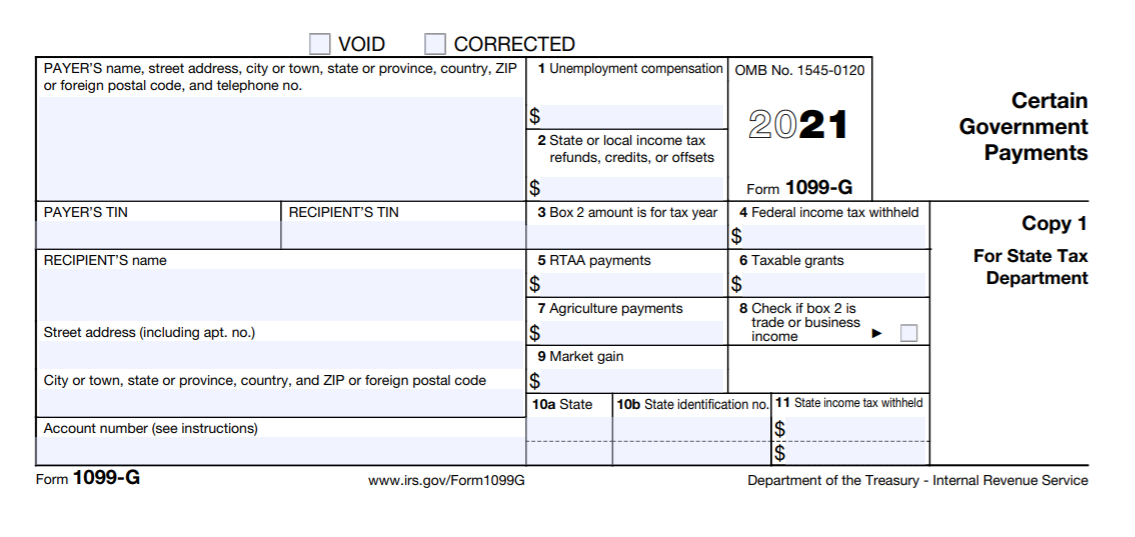

However because this credit reduces the tax. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. The IRS is sending unemployment tax refunds starting this week.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The IRS has sent 87 million unemployment compensation refunds so far. 10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early.

Much like with the stimulus check payments if you provided you bank account details on the 2020 tax return you will receive the money as direct payment to your bank. If you claim unemployment and qualify for. Blake Burman on unemployment fraud.

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed Unemployement. The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits per person. Last year my husband and I filed our 2020 joint tax return before the implementation of the American Rescue Plan excluded 10200 of unemployment payments.

Fort Lee NJ 07024 201 308-9520. Many filers are able to protect all or a portion of their income tax refunds by applying their. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

This is the fourth round of refunds related to the unemployment compensation. Even though the chances of speaking with someone are slim you can still try. If that quarters taxes were not yet paid at the time no.

The average refund amount is higher for the second round because the IRS is also adjusting the Advance Premium Tax Credit APTC based on additional tax relief provided for. Unemployment and tax credit rules. ANCHOR payments will be paid.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Unfortunately an expected income tax refund is property of the bankruptcy estate.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. We will begin paying ANCHOR benefits in the late Spring of 2023. This is not the amount of the refund taxpayers will receive.

In response to the COVID-19 pandemic my state has issued a refund of first quarter 2020 state unemployment taxes. The American Rescue Plan made 10200 in benefits per person tax-free. Child Tax Credit Receiving unemployment income wont prevent you from claiming the Child Tax Credit.

The IRS is starting to send refunds to those who paid taxes on their unemployment benefits in 2020.

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

Just Got My Unemployment Tax Refund R Irs

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits